Florida lawmakers are considering legislation limiting the rights of every citizen in the state. Bills HB 837 in the Florida State House of Representatives and SB 236 in the Florida State Senate.

Floridians are paying the highest auto and homeowners insurance premiums in the nation — and those rates continue to rise.

Lawmakers have been convinced by the insurance industry and big business – Disney, Publix, Trucking companies, etc. – that insurance rates and the cost of doing business in Florida are too high because they get sued.

Why Do Corporations & Insurance Companies Get Sued?

- Insurance companies get sued because they have failed to uphold their insurance contract and fairly pay claims.

- Trucking companies get sued because they have made Florida’s roadways unsafe.

- Disney gets sued because they have failed to maintain their rides or provide a safe environment for visitors to their properties.

- Companies get sued when they fail to uphold their contract or cause harm to you or your family. However, the corporate elite in Florida have now gone to lawmakers and convinced them that they should not be held responsible for the harm they cause – and what’s worse, they want to put a price tag on the value of an injured victim’s life.

The question is: will insurance rates really go down?

Nowhere in the bill does it say that these insurers will reduce their rates by the amount of money that they save by not paying off the claims.

What These Bills Do

There are six main provisions of HB 837/SB 236 that would make unprecedented changes to Florida’s civil justice system, including:

- Bad Faith Reform – Removes protections from Florida’s Bad Faith laws that incentivize insurers to treat policyholders fairly.

- Limitations on Medical Damages – The bill proposes denying juries access to accurate information about the actual costs of both past and future medical expenses.

- Attorney Fees Reform (627.428) – The legislation seeks to repeal 627.428 which has existed for more than 130 years to protect David against Goliath. It protects insurance consumers who purchase auto, health, life, or any other first-party insurance from companies that would otherwise delay, deny, or underpay claims.

- Moves Florida to a Contributory Negligence Standard – The bill would shift Florida from a comparative fault standard to a contributory negligence standard of fault.

- Eliminates Negligent Security Safeguards – The bill guts protections for employees and patrons of businesses that currently have a duty to ensure their safety.

- Statute of Limitations Cut in Half – An amendment added to HB 837 would change the statute of limitations on all negligence claims from four years to two.

How These Bills Harm Everyday Floridians

- This bill would take away our right to trial by jury, and instead have trial by the king/government and government-imposed limits on the amount that injury victims can recover for their medical damages.

- It’s wrong to allow the insurance industry (through the government) to limit medical payments for injury victims to 140% of Medicaid. Limiting medical damages will result in medical debt for victims and the most injured victims going into government institutional care, instead of the best care victims of negligence deserve.

- This bill would make Florida a more dangerous place by letting hotels, apartment complexes and daycare centers blame the very criminals these establishments are supposed to be protecting us from and would eliminate incentive to exercise reasonable care to protect residents/customers/children in their care (security, video surveillance, fences, locks, protection etc.)

- Taking away the right to fees when insurance companies wrongfully deny benefits would hurt every insurance policy holder, including life insurance and health insurance because the insurance industry, without the threat of consequences for bad actions, will always underpay, forcing the policyholder to find/hire/pay a lawyer to take a case for benefits they are entitled to in the first place.

What Attorneys Are Saying

“What this bill does is it allows the insurance companies to be able to delay, delay, delay and deny claims and then pay out low ball claims,” said Attorney Keith Ligori

Attorneys also expressed concern regarding comparative negligence reform, which they say will allow those who are found almost equally at fault in an accident can walk away without paying any damages.

Attorney Stephen Barnes gives an example of someone texting and driving who runs a stop sign and injures another driver:

“The insurance company for the person who was texting and ran the stop sign can go hire an expert and figure out that maybe the other driver was going five or 10 miles over the speed limit. And then make an argument that ‘You know what? Their speeding was 51% the cause of this accident, and the texter that ran the stop sign was 49%. Under this bill, the person who was texting and ran a stop sign would get off without paying a dime, so would their insurance company,”

What Doctors Are Saying

Dr. Jay Parekh said one of his biggest concerns is that patients with health insurance will get delayed care, and those without may be denied care.

“I’ve had patients who’ve had massive herniated discs following a car accident, who need immediate surgery. And we don’t really realize that until they get that MRI done,” he said. “Now, if this bill goes through, and that patient has to wait two to four weeks or six weeks to have an MRI done, they might get paralyzed.”

How You Can Help Fight Back

- Tell Your State Official To Vote No! –

Not Sure What To Say? Use Our Template

As a native Floridian, I am writing to urge you, my elected representative, to oppose this bill (HB 837/SB 236) which threatens the rights of all Floridian’s and their families who suffer loss because of another’s negligence. Rather than giving victims justice, this bill restricts their recovery for past and future medical expenses. This will limit access to healthcare and impose financial burdens on victims, especially those without health insurance who do not qualify for Medicare or Medicaid. Ultimately, Florida taxpayers will be left holding the bill for this. By shifting Florida to a contributory negligence standard, this bill protects wrongdoers and leaves taxpayers responsible for paying victim’s expenses. It also restricts access to courts in cases where liability is disputed. Next, removing safeguards to protect consumers from powerful insurance companies will lead to the unreasonable delay of claims. Victim’s suffering will be prolonged as insurance companies do whatever they want knowing they won’t be held accountable. Meanwhile, insurance companies make no promises to lower insurance premiums we know to be so high in this State. Lastly, reducing Florida’s Statute of Limitations from 4 years to 2 years will only force more lawsuits to be filed. This will create a heavier burden on the court system and increase legal expenses for all sides. It will also restrict access to courts for many victims. For the protection of your constituents, I implore you to vote no on this bill. Thank you!!

- Share Your Story

If you have a story that can help shine a light on the dangerous risks and financial burden’s these bills place on Floridians, please fill out the form on this page so that we can contact you.

If you qualify, we can put you in touch with the Florida Justice Association about testifying in Tallahassee as we advocate for justice for all!

Tell Us Your Story

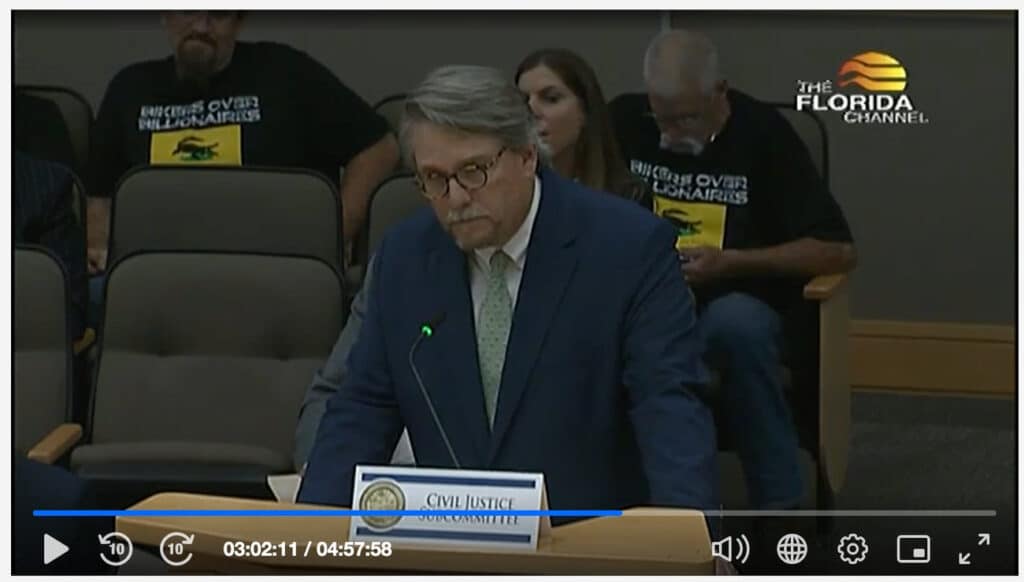

Florida Channel House Civil Justice Subcommittee hearing on HB 837 on 2/24/23

You can watch the hearing and impactful testimony from various opponents, including many survivors of negligence here or by clicking on the picture below.

Additional Resources About These Bills

Florida lawmakers’ answer to insurance crisis: Make it harder to sue insurers | Bradenton Herald

Family members of local crime victims unite in opposition to HB 837 | WPLG

Tort reform bill seeks to balance Florida’s ‘judicial hellhole’ while opponents call it gift to insurers | WPTV

Big trucking v. families: Let’s put safety first | Tallahassee Democrat

Protecting trucking companies at the expense of crash victims, public safety | Florida Politics

Change sovereign immunity law that leaves Floridians suffering | Sun Sentinel

It’s not about ‘billboard lawyers’; repealing attorneys’ fee law harms working-class Floridians | Sun Sentinel